3 China News Stories Shippers Should Know About

Yuan Value Continues Decrease, Rising China Market Volatility

Creative Commons image by Alexmar983

China’s renminbi, commonly referred to as the yuan, has made many headlines this last year. Big drops in value, accompanied by drops, even a crash, of China’s stock market have been in the buildup to the International Monetary Fund adding China’s currency to the world’s main central bank reserve currencies.

Now we’re seeing another big drop in the value of the renminbi as Reuters reports:

China allowed the biggest fall in the yuan in five months on Thursday, pressuring regional currencies and sending global stock markets tumbling as investors feared it would trigger competitive devaluations.

…

The People’s Bank of China shocked traders by setting the official midpoint rate on the yuan, also known as the renminbi (RMB), 0.5 percent weaker at 6.5646 per dollar on Thursday, the lowest since March 2011.

That tracked record losses in the more open offshore currency market and was the biggest daily fall since an abrupt devaluation of nearly 2 percent last August.

… the central bank’s fixings have also helped drive the yuan down this week against other major currencies, including a 3.5 percent fall against the yen and 0.8 percent against the euro.

That raised concerns that China might be aiming for a competitive devaluation to help its struggling exporters.

The yuan dropping in value is something U.S. shippers who import from China can take advantage of, lowering cost on imported products and increasing profit.

Conversely, yuan devaluation is not so good for U.S. shippers exporting to China. As spending power decreases in China, so does the confidence of Chinese buyers and demand for American products.

Overall, the volatility sudden drops create in China’s market, which ripples to other markets around the world, is negative. Much of the problem comes from China’s manipulation of the currency and the market itself.

China put a new circuit breaker mechanism on the market that shuts it down when big drops happen. So when China stocks fell 7 percent Thursday, the mechanism was triggered and the market was shut down for the rest of the day.

Now add to that a new rule China is putting on their market, effective January 9th, that investors can’t sell more than a single percent of a listed company’s share capital every three months and you can easily see why there is frustration and a loss of faith in China’s market.

The Reuters article sums up the feelings of investors:

“This is crazy,” said Alberto Forchielli, founder of Mandarin Capital Partners. “Chinese regulators set off on this path in July and they cannot get out of it. They have ruined whatever hope investors still had in the market.”

This is an example of the negative results of a government trying to control the market. Doubtless, many shippers will end up feeling the impact of the volatility.

China Successfully Flies To and From New Airfield in South China Sea

A couple test flights landing on and taking off from a new Chinese airstrip have been making headlines. There would be nothing remarkable about planes landing on and taking off from a new airstrip, except for the fact that in this case the airstrip is in the South China Sea.

A couple test flights landing on and taking off from a new Chinese airstrip have been making headlines. There would be nothing remarkable about planes landing on and taking off from a new airstrip, except for the fact that in this case the airstrip is in the South China Sea.

Things are getting intense in the South China Sea.

China has been building islands on reefs there, complete with airstrips, and this has been angering neighboring countries.

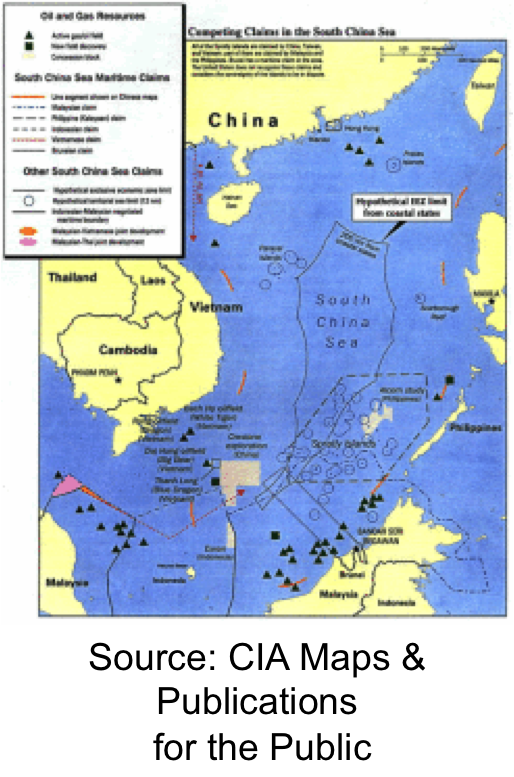

The problem is overlapping territorial claims in the South China Sea. China, Vietnam, the Philippines, Brunei, Malaysia, and Taiwan all have claims in the South China Sea. But tensions are especially high between China, Vietnam, and the Philippines over their conflicting territorial claims.

The U.S. has also gotten involved in these tensions, sending warships through the waters, ignoring China’s claim that building islands on the reef in the sea creates territorial waters around them that cannot be legally entered by crafts of other countries.

China’s spin on the new islands and airstrips is that they are being developed “for humanitarian purposes including emergency landings and maritime rescues,” as can be read in a New China article. But certainly there are military applications too, which China does not deny.

Remember, the waters of the South China Sea are hugely important to international shipping with about $5 trillion of cargo a year shipped through the major shipping lanes there, making the building tensions important for shippers to keep an eye on.

Here are the reactions coming off the recent flights reported in the Guardian.

The flights followed a maiden voyage on Saturday that drew an angry protest from rival claimants Vietnam and the Philippines.

China’s creation of seven new islands by piling sand on reefs and atolls has been condemned by its neighbours and the US, which accused Beijing of raising tensions in an area where six governments maintain overlapping maritime territorial claims.

The US State Department responded to Saturday’s flight by reiterating calls for a halt to land reclamation and militarisation of outposts in the waters.

In Manila, the visiting British foreign secretary, Philip Hammond, said freedom of navigation and overflight in the South China Sea was non-negotiable and urged rival governments to avoid provocative steps.

China has rejected calls for a halt in island construction, saying its claim of sovereignty over the entire area gives it the right to proceed as it wishes. It says the new islands are principally for civilian use but also help defend Chinese sovereignty.

Vietnam Building Up Arms in Disputed South China Sea

Vietnam’s response to China landing planes in the South China Sea was furious, according to a story in the Sydney Morning Herald, labeling it as a “serious infringement of the sovereignty of Vietnam”.

Vietnam’s response to China landing planes in the South China Sea was furious, according to a story in the Sydney Morning Herald, labeling it as a “serious infringement of the sovereignty of Vietnam”.

In the midst of tensions in the South China Sea, Vietnam is building up arms, including advanced submarines, there.

The Sydney Morning Herald article mentioned above outlines the arms and submarines Vietnam has been acquiring and positioning in the South China Sea:

The first of Vietnam’s new advanced Kilo-class submarines have begun patrolling disputed waters of the South China Sea, as deterrents to China’s 10 times-bigger navy, Vietnamese officials and diplomatic sources say.

Vietnam is also expanding use of its strategically important Cam Ranh Bay deep-water harbour, where six of the submarines will be based by 2017.

The arrival of the submarines from Russia is a key part of Vietnam’s biggest arms build-up since the height of the Vietnam War, which could significantly change the balance of power in the flashpoint South China Sea, analysts say.

As concern has increased about China’s aggressive claims to almost all of the disputed water, Vietnam has been spending billions of dollars developing a submarine fleet, shore-based artillery and missile systems, multirole jet fighters and fast-attack ships, most of which have [been] bought from Russia and India.

…

The country has also recently upgraded and expanded air defences, including obtaining early-warning surveillance radar from Israel and advanced S-300 surface-to-air missile batteries from Russia.

China shows no signs of letting up on its aggressive claims on the South China Sea and Vietnam is showing it will not give up its claims without a fight.

The major shipping waters of the South China Sea seem to be getting more and more dangerous every day. When tensions finally do boil over, world trade will be significantly impacted.

Related Reading

![]()

Source: UC Blog