The labor dispute coming to an end at the West Coast ports does not mean the ports have regained shippers’ confidence.

It will take months to clear up the congestion that reached critical levels during the International Longshore and Warehouse Union (ILWU) contract negotiations with the Pacific Maritime Association (PMA), but many shippers have decided to divert their cargo away from the West Coast ports for years.

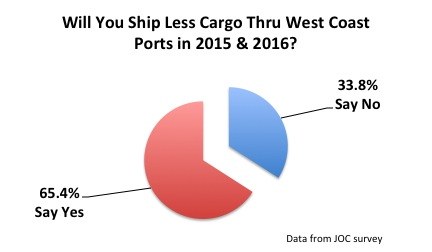

Mark Szakonyi wrote a great article for the Journal of Commerce (JOC), which shared the results of their survey of 138 shippers regarding whether or not they planned to divert cargo from West Coast ports in 2015 and 2016.

The results of the survey are not good for West Coast ports.

Just over 65% of the shippers who responded to JOC’s survey reported that they plan to divert cargo from West Coast ports in 2015 and 2016.

These shippers don’t plan to return their cargo to West Coast ports after those two years finish, either. According to the JOC article, “The percentage of shippers planning to permanently reroute some cargo away from the coast is nearly identical to the 66 percent of shippers who said the same thing when they were surveyed by JOC.com in mid-December.”

These shippers don’t plan to return their cargo to West Coast ports after those two years finish, either. According to the JOC article, “The percentage of shippers planning to permanently reroute some cargo away from the coast is nearly identical to the 66 percent of shippers who said the same thing when they were surveyed by JOC.com in mid-December.”

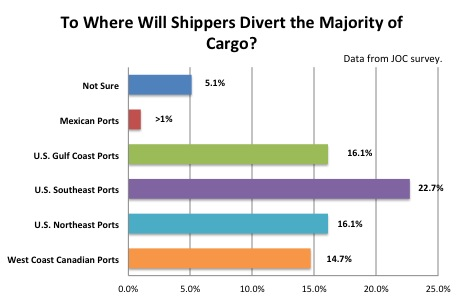

To where do the shippers plan to divert their cargo?

While JOC’s article indicates a little over 5% of shippers diverting their cargo are unsure to where, the biggest winners of diverted West Coast port cargo are U.S. East Coast ports. Southeast U.S. ports should receive 22.7% of the diverted cargo while U.S. Northeast and Gulf Coast ports are at a dead heat with an expected 16.1% of the cargo.

Not all diverted cargo will go through U.S. ports at all. 14.7% of shippers planning to reroute their cargo reported plans to divert cargo to the Ports of Metro Vancouver and Prince Rupert. Less than 1% said they will use Mexican ports.

Here’s a bar graph of where West Coast cargo will be diverted to in 2015 and 2016 from JOC’s survey data:

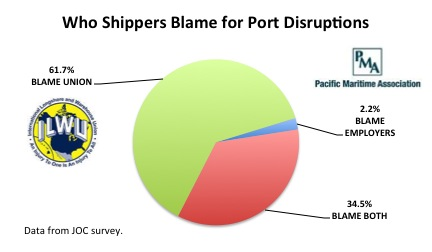

Who’s to blame for the West Coast ports losing cargo?

Who’s to blame for the West Coast ports losing cargo?

During the ILWU contract negotiations, port congestion badly hurt U.S. importers and exporters. Delays, fees, lost sales, lost business partners… the damage done to the U.S. economy is in the billions of dollars.

The JOC survey asked shippers whom they blamed for the disruptions at the West Coast ports during the contract negotiations. Was it the union’s fault or the employers’ fault or both?

Largely, shippers blamed the union.

61.7% of the shippers surveyed put the blame solely on the ILWU while only 2.2% of the shippers put the blame solely on the PMA according to the JOC article. 34.5% blame both parties, the union and the employers.

West Coast ports didn’t actually have to wait for 2015 and 2016 to see cargo diverted to other ports.

Mark Szakonyi reported in the JOC article:

There were already diversions by importers under way last year, especially in the fourth quarter when the West Coast congestion was at its worst. Fourth-quarter import growth was 12.6 percent on the East Coast, 11.8 percent on the Gulf Coast and 5.3 percent on the West Coast, compared to the fourth quarter of 2013. The data is from PIERS, a sister product of JOC.com within IHS.

That dropped the West Coast’s share of imports slightly from 54.57 to 54.04 percent, and increased the East Coast’s share of imports from 39.32 percent to 39.85 percent, and the Gulf Coast’s share from 6.11 to 6.12 percent, according to PIERS.

West Coast ports are making moves to clear the congestion and regain the confidence of shippers. These include a chassis initiative and a free-flow container operation that we’ll talk about in an upcoming blog.

For many shippers, these actions to clear congestion are too little, too late.

On top of that, they feel the issue of labor disputes, especially whenever a new contract is being negotiated, is a core cause of unreliability at West Coast ports that no moves are being made to resolve.