During the 3rd quarter of the year, international shipping spikes with retailers importing goods for back to school sales and the holidays. We call it the peak season. Carriers increase capacity as importing and exporting goods hugely increase. It’s importance to ocean carriers, freight forwarders, and shippers can’t be overstated; however, according to Drewery, the importance of the peak season is waning.

The proportion of annual cargo container shipments during the 3rd quarter peak season has dropped over the last few years.

The proportion of annual cargo container shipments during the 3rd quarter peak season has dropped over the last few years.

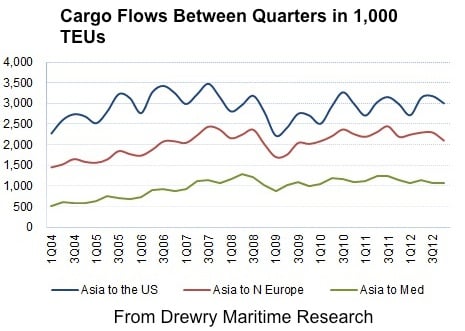

The graph to the right from Drewery’s research shows the way cargo shipments have spiked during the 3rd quarter (peak season) from ’04 to 2012.

The international shipping industry has come to expect large spikes in that 3rd quarter, often that is what makes the year break into profits for companies.

In the graph, you can see spikes decreasing in recent years. Ah, squiggly lines just aren’t what they used to be.

Looking at those spikes, it might not even seem like that big of a change in the patterns of shipping and not that big of a deal.

Obviously, there are still spikes in the peak season, but decline in the amount of increase seen in the peak season is reason for carriers and others in the international shipping industry to be concerned.

The indication seems to be a change in spending patterns and shipping patterns, according to Drewery’s research. Ocean carriers and NVOCCs like freight forwarders need to adjust to the way shipper’s needs and practices are changing.

Here’s how Drewery puts it:

Compared to the halcyon pre-recession days of 2004-2007, when an average 27.1 % of each year’s total traffic was shipped from Asia to the US between July and September, only 26.4% was shipped last year. The proportion to Northern Europe fell from 26.8% to 25.7%, and to the Mediterranean, from 26.1% to 24.4% respectively.

The differences may seem small, but it does suggest that consumers’ buying patterns are changing, or traders have found a better way of meeting their needs, at a time when ocean carriers’ usually inject additional vessel capacity and container equipment. In other words, the seasonal transition from winter to summer cargo flows in the northern hemisphere has become more gradual, with stocking up for the summer in the second quarter gaining in importance.

We used to always hear about the peak season from carriers and with the peak season, a peak season surcharge would come.

Suddenly, the words peak season haven’t been on everybody’s lips anymore and carriers have been having trouble imposing a solid peak season surcharge through the peak season.

What we’ve seen over the last couple year’s, especially as carriers have been recovering from heavy losses in 2011, are GRIs or General Rate Increases that Drewery says “may be a more honest way of requesting freight rate increases” than a peak season surcharge.

Drewery goes on to say, “Extra money in the peak season to pay for the risks associated with the sudden provision of extra vessel capacity and temporary container equipment imbalances no longer seems such a big deal.”

Perhaps this is in part because carriers have been implementing GRIs throughout the year (not just during peak season) in order to bring freight rates back up to profitable margins over the last couple years.

Drewery’s final conclusion about the change in shipper’s patterns and the drop in the peak season is as follows:

Whatever happens, the change in buying pattern means that, in the interim, ocean carriers can no longer rely on the third quarter of each year being such a high revenue earner. It also means that the seasonal introduction of additional vessel capacity needs to be made gradual from March onwards, instead of being designed around the third quarter only.

Maybe the decline of 3rd quarter, peak season shipping over the last few years will not continue into the future. Perhaps, as economies continue to recover from recessions and lows that have been experienced, peak seasons will see growth.

Then again, the decline in the peak season could just as easily continue and the international shipping industry will change its practices to meet the demands of its customers.

No matter what, Universal Cargo Management will be here to handle your shipping needs.

Click Here for Free Freight Rate Pricing

—

Source: