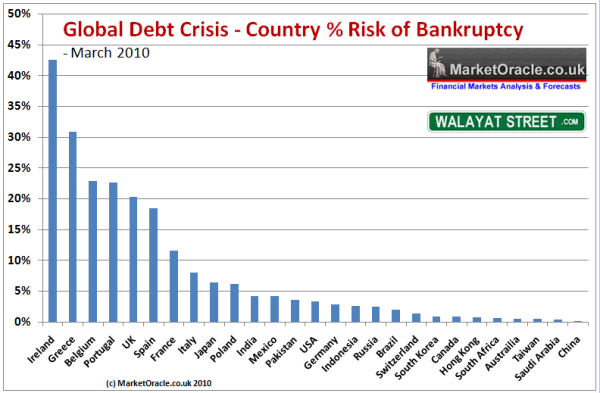

Greece had an issue spending too much money on salaries and austerity benefits. This pressed the country to the brink of Receivership. Not such a thing for Sovereigns- but all of Europe was shaken given the weak balance sheet of so many European Countries that are in not to dissimilar standing – so the EU organized a Loan package/Bail-out stemming the feared “Domino Affect” threatened by the near Greek Tragedy.

Greece had an issue spending too much money on salaries and austerity benefits. This pressed the country to the brink of Receivership. Not such a thing for Sovereigns- but all of Europe was shaken given the weak balance sheet of so many European Countries that are in not to dissimilar standing – so the EU organized a Loan package/Bail-out stemming the feared “Domino Affect” threatened by the near Greek Tragedy.

Once the provisions were in place, labor unions carried on their strikes and riots weakening the tourism sector, one of the largest planks of their shaky economy, and source of tax revenue. Smart – yes?

Fast forward 6 months. Ireland’s banks are all but insolvent. Why? Real-estate dropped in value so much last year that the balance sheets of homeowners and Banks alike were nearly wiped clean. People saw the weakness in the banks and began with drawing their deposits from those banks holding liabilities for assets – devalued real-estate – which brought them to now – an insolvent Banking System.

The true issue is how this affects the UK. The Brits have lost so much of their investment value made in Ireland – that with out an EU bail-out/loan deal for Ireland – this crisis puts pressure on the UK Banking System, even to the point potentially collapsing the banking system in the UK. The fear, that soon to fallow – the collapse of all of Europe’s banking system.

This sound somewhat failure? A slightly different version of what happened in the US not long ago.

Portugal: Next on the radar. Debt as fare as they can see due to over paying public employees (click over here to know what is the best iva advice to tackle this sitaution) – the country a victim of “Collective Bargaining” – Labor unions. Portugal real-estate has also dropped in value. Spain has heavy investments in Portugal, so there fate is dragging Spain down threatening to expose weak fundamentals on which the Spanish economy and Government now sits. “Green” economy currently boasting 14-20% unemployment. If Portugal does not receive needed help from the EU it too may pull down Spain and this too threatens all of the European Banking System.

Why is this an issue? As an importer/exporter the ramifications are multitudinous. But we will look at only one.

The US monetary policy is and has been over the last 2 years, to inflate our way out of our version of this type of crisis. Pump untold Trillions into the economy by printing money wholesale out of thin air. This drives inflation – devaluing our currency -making our products cheaper for other countries to buy. This is just one aspect of devaluing a nations currency – and the hope of the Obama administration is that this will spur the US economy into higher levels of growth.

This may work up to a point. But, Europe, the world’s second largest market, has no money to buy our goods on the scale the administration is hoping for. The IMF (International Monetary Fund) is so tied up with helping the EU that it limits “investment” resources for Africa. So Africa will not be a huge boon to exporters looking for sustainable growth.

So the markets where US companies can focus, in large measure on exports, are going to be South America and China. Even though China is reeling under inflationary pressures, there are many goods that the Chinese love, exposing an insatiable appetite for those newly cherished things.

South America has pockets of growth that need goods and services imported in a much grandeur scale than they have ever needed previously. This in part due to all the Americans now traveling to and even relocating in South America, particularly, Costa Rica, Panama, Chile, and Argentina.

So – one looking to export might consider probing those markets and asking: “What can I supply in those markets, cost effectively – right now?”

Given the trends, this question, and faithful follow-through you may never have to face you own “sovereign debt crisis”.

Dave Stover