Good News, Bad News: Yantian Port Back to Full; Freight Rates Rise Even Higher

It’s a classic case of good news, bad news.

After Tuesday’s bad news blog about Yantian Port’s partial shutdown lingering and creating a “worse-than-Suez” level of international shipping disruption, it’s nice to have some good news on the topic to report today.

Good News: Yantian Port, one of the busiest ocean freight ports in China, is back to full operation today (Thursday, June 24th). This, according to Greg Knowler and Keith Wallis of the Journal of Commerce (JOC):

Shenzhen’s Yantian International Container Terminals (YICT) will resume full operations early Thursday, but the huge backlog of boxes stacked up during four weeks of severe congestion will need to be flushed out on top of growing peak-season demand.

That’s right, we couldn’t even make it through the first sentence of Knowler and Wallis’s article before getting to bad news.

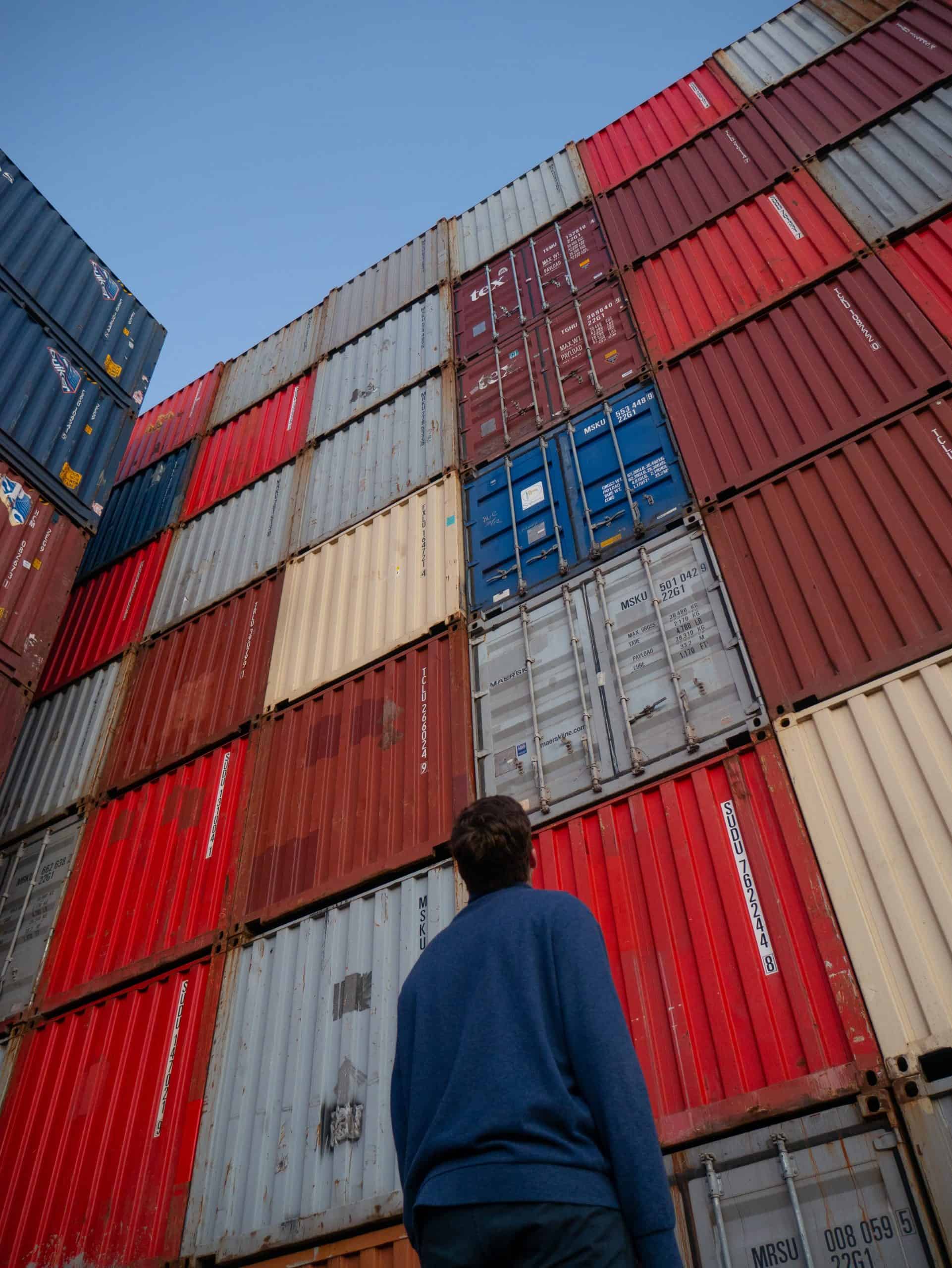

Bad News: Yantian’s congestion and backlog of shipping containers as well as cluster of container ships waiting at anchor will take some time to clear.

Good News: Chinese ports are more efficient than U.S. ports, where dockworker unions have effectively fought against modernization and automation, allowing for quicker clearing of congestion there than is possible at ports like Los Angeles, Long Beach, and New York.

Bad News: International shipping’s peak season is in full swing. Increasing demand on already higher-than-normal demand for goods from China to the U.S. will make it harder for Yantian Port to recover quickly.

Good News: Nearby ports – like the Ports of Hong Kong, Shekou, and Nansha – can help lighten the load for Yantian Port.

Bad News: While sharing Yantian’s load, these other ports also share in suffering congestion. Knowler and Wallis report:

“Yantian is one of the most important gateway hubs globally, and the ripple effect of the partial closure of the port has led to port congestion in nearby ports, such as Nansha, Shekou, and Hong Kong,” [a Maersk China spokesperson] said.

Good News: Shippers are learning the lesson to diversify their product sourcing.

Universal Cargo CEO Devin Burke went to High Point Market earlier this month, where those in the furniture industry gather. It’s a chance to mingle with furniture importers, more than a few of whom are Universal Cargo clients. Mr Burke told me about conversations he had with those in the furniture industry who have diversified sourcing that previously leaned heavily on China. Importing from Mexico, thanks in no small part to USMCA replacing NAFTA, is a popular alternative. Sourcing and shipping furniture domestically is another choice growing in popularity, as sky-high freight rates from China are dissolving import savings over U.S. manufacturing. Burke highlighted one conversation in which a furniture importer said he stopped shipping from China altogether.

Bad News: Port congestion in China will intensify and prolong the peak season as it takes weeks to clear.

Knowler and Wallis quote John Painter, CEO of Guangzhou Port America, as saying, “The backlog of containers will surely cause a more intense peak season…” That was followed immediately by Painter, too, talking about shippers (and carriers) diversifying their supply chains: “… but I truly believe shippers as well as carriers have learned a valuable lesson — to diversify ports not only at destinations, but at origin ports as well, which helps balance out and protect the supply chain.”

Good News (if you’re an ocean freight carrier): Freight rates are continuing their meteoric rise.

Bad News (if you’re a shipper): Freight rates are continuing their meteoric rise.

This is kind of like the old Good Idea, Bad Idea sketch from the 90’s cartoon Animaniacs where “playing catch with your grandfather” was both the good and bad ideas.

Yes, freight rates continuing to rise is both good and bad news. It just depends on your perspective. Of course, for most of us, our perspective makes it bad news. That’s because most of us are shippers rather than ocean freight carriers.

Freight Rates to the Moon

Greg Miller lays out the out-of-this-world freight rates we’re seeing right now in an American Shipper article:

The trajectory of trans-Pacific spot rates brings to mind the retail-trader catchphrase “to the moon.” Index rates (which do not include premium charges) have just crossed the line into five figures per day.

Carriers implemented general rate increases (GRIs) on June 1. Spot rates rose. They enacted more GRIs on June 15. Rates jumped again. Another wave of GRIs is set for July 1 and more have just been announced for July 15. Add fallout from China port congestion to the mix, and it’s a recipe for rates to keep climbing.

Miller reports the indices on freight rates from Asia to the U.S., and, of course, we’re seeing new heights:

Asia to U.S. East Coast

On June 15, the day carrier GRIs were implemented, the Freightos Baltic Index daily assessment for Asia-East Coast jumped 7%. It kept rising after that, reaching an all-time high of $10,104 per FEU by the end of the week — the first time this route index breached $10,000. As of June 22, it was at $10,002 per FEU assessment, up 205% year on year (y/y).

S&P Global Platts provides daily assessments of Freight All Kinds (FAK) rates. Its North Asia-East Coast FAK assessment was $7,100 per FEU on June 22.

Drewry released its latest weekly rate assessment for the Shanghai-New York route on June 17: $8,017 per FEU, up 195% y/y.

Asia to U.S. West Coast

The Freightos Baltic Index daily assessment for Asia-West Coast also jumped after the latest round of GRIs. By June 22, it was at a new all-time high of $6,681 per FEU, up 160% y/y.

Drewry’s latest weekly rate for Shanghai-Los Angeles was $6,358 per FEU, up 197% y/y. S&P Global Platts’ daily North Asia-West Coast FAK assessment for June 22 was $5,800 per FEU.

Universal Cargo Is Here to Help

Universal Cargo is always ready to help you with your importing (and exporting). Whether you’re weathering the storm of high freight rates through continued importing from China or diversifying your sourcing, shipping from other countries or even going with domestic manufacturing and shipping, contact Universal Cargo today.