Ports of Los Angeles & Long Beach Delay Fees Again – Happy Thanksgiving!

The Ports of Los Angeles and Long Beach seem happy to keep dangling the threat of incredibly high container dwell fees to induce movement of import shipping containers out of the ports’ terminals.

On Monday (November 22nd), when the new but temporary fees were supposed to go into effect, the Port of Los Angeles put out a press release announcing the fees are on hold until November 29th.

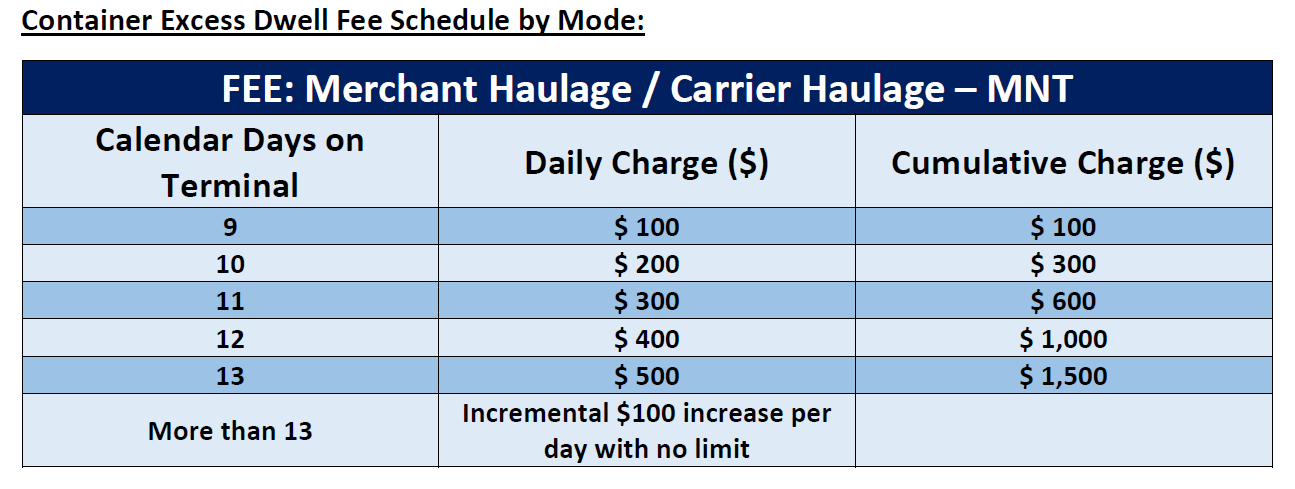

That’s a happy Thanksgiving gift for shippers. While these fees are technically placed on shipping lines, those ocean freight carriers plan to pass the fees on to shippers. The fees are steep too. They start at $100 per shipping container. Each day, the fee increases by another $100 and is added to the amount already owed. The cumulative effect is a rapidly increasing fee that would get out of hand fast.

The following chart shows how big the threatened fees are, starting at day 9 when they are supposed to take effect, and what the cumulative charge per container would be if failure to move the cargo occurred:

For shipping containers waiting for rail rather than truck to get them out of port terminals, these fees would begin after only 6 days instead of 9.

This is the second time these fees have been postponed. We just blogged last week about them being delayed the first time.

The obvious point is to scare shippers and carriers into getting cargo containers out of the ports before they have to pay these exorbitant amounts. If shipping containers move well enough, though no exact amount of shipping containers cleared has been given, that would satisfy the ports enough to keep from implementing this fee hike.

Apparently, it’s working. The Port of Los Angeles said in its press release that aging cargo on the docks have declined by 33% since the this big dwell fee was announced.

Of course, correlation doesn’t necessarily mean causation. However, it would be awfully coincidental to say the two weren’t related. Because there are other factors at play to reduce dwelling containers on the docks and port congestion in general, it wouldn’t be as coincidental as saying a novel coronavirus outbreak hitting a city had nothing to do with the fact that city just happened to have a virology lab doing gain of function research on coronaviruses. Still, the connection would be hard to deny. Certainly, no one will be labeled a conspiracy theorist for going along with the connection between the fee threat and the movement of containers.

A second postponement of this fee does give hope that it will not be implemented at all. Here at Universal Cargo, we’ll be keeping a close eye on it.

Here’s the full text of the Port of Los Angeles’s press release:

‘CONTAINER DWELL FEE’ ON HOLD UNTIL NOV. 29

San Pedro Bay Ports Cite Continued Improvements on Marine Terminals

SAN PEDRO, Calif. — Nov. 22, 2021 — Following meetings today with U.S. Port Envoy John Porcari and industry stakeholders, the Port of Los Angeles and the Port of Long Beach announced further postponement of the “Container Dwell Fee.” With continued progress moving containers off marine terminals, the fee will not be considered before Nov. 29.

Since the fee was announced on Oct. 25, the twin ports have seen a decline of 33% combined in aging cargo on the docks. The executive directors of both ports are satisfied with the progress thus far and will reassess fee implementation after another week of monitoring data.

Under the temporary policy approved Oct. 29 by the Harbor Commissions of both ports, ocean carriers can be charged for each import container that falls into one of two categories: In the case of containers scheduled to move by truck, ocean carriers could be charged for every container dwelling nine days or more. For containers moving by rail, ocean carriers could be charged if a container has dwelled for six days or more.

The ports plan to charge ocean carriers in these two categories $100 per container, increasing in $100 increments per container per day until the container leaves the terminal.

Before the pandemic-induced import surge began in mid-2020, on average, containers for local delivery remained on container terminals under four days, while containers destined for trains dwelled less than two days.

Any fees collected from dwelling cargo will be reinvested for programs designed to enhance efficiency, accelerate cargo velocity and address congestion impacts.

The policy was developed in coordination with the Biden-Harris Supply Chain Disruptions Task Force, U.S. Department of Transportation and multiple supply chain stakeholders.